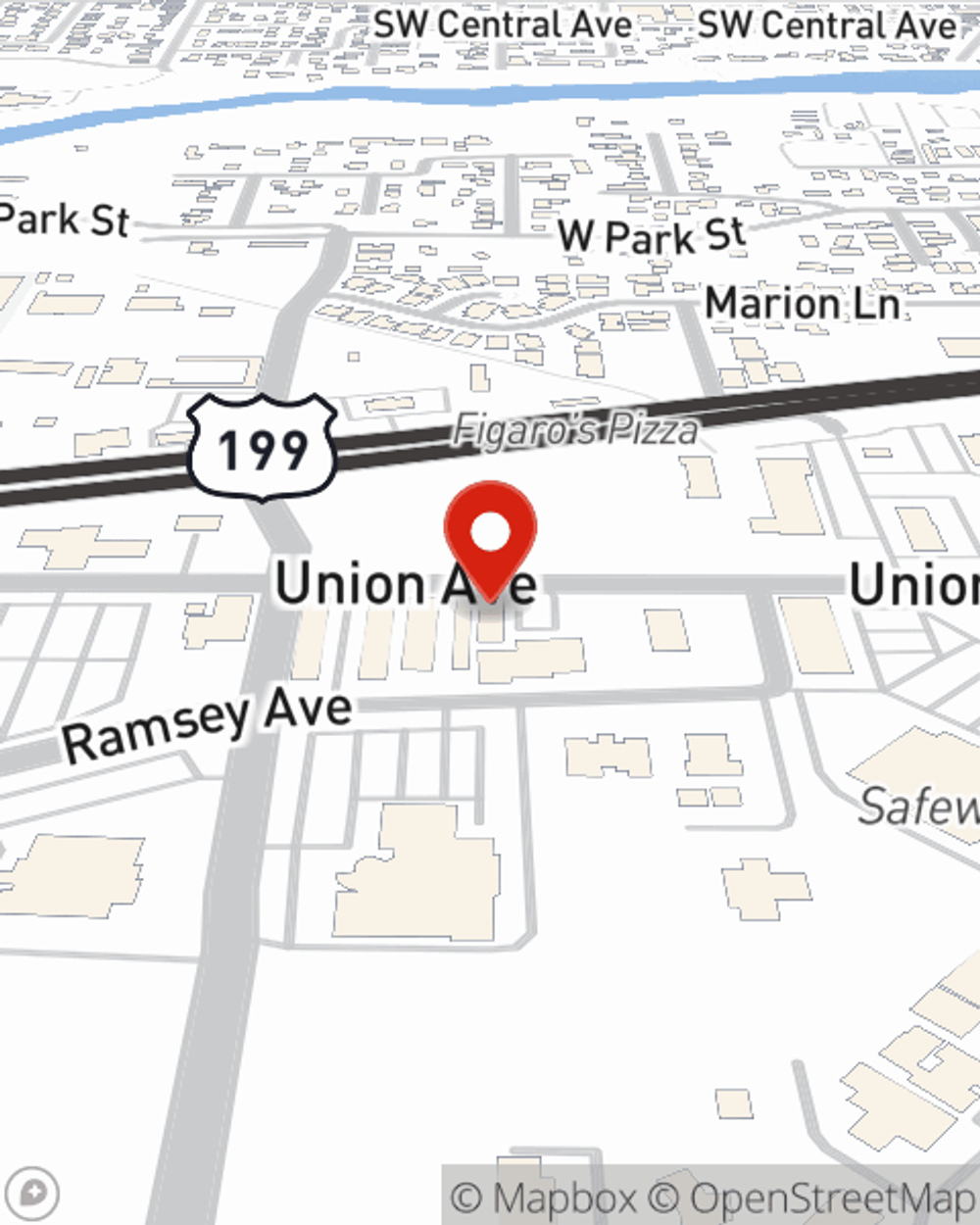

Business Insurance in and around Grants Pass

One of the top small business insurance companies in Grants Pass, and beyond.

Helping insure businesses can be the neighborly thing to do

- Williams

- Josephine County

- Jackson County

- Merlin

- Cave Junction

- Rogue River

- Central Point

- Medford

Help Prepare Your Business For The Unexpected.

Running a small business comes with a unique set of highs and lows. You shouldn't have to work through those alone. Aside from just those who care for you, let State Farm be part of your line of support through insurance options including extra liability coverage, a surety or fidelity bond and worker's compensation for your employees, among others.

One of the top small business insurance companies in Grants Pass, and beyond.

Helping insure businesses can be the neighborly thing to do

Keep Your Business Secure

When you've put so much personal interest in a small business like yours, whether it's an art gallery, an arts and crafts store, or a floor covering installer, having the right insurance for you is important. As a business owner, as well, State Farm agent Tom Randall understands and is happy to offer exceptional service to fit the needs of you and your business.

Ready to discuss the business insurance options that may be right for you? Get in touch with agent Tom Randall's office to get started!

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Tom Randall

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.